- Academic

- Austerity

- Budgets

- Cities

- Education

- Inequality

- Poetry

- Press

- Publications

- Stream

- Uncategorized

California’s public sector staffing crisis

The Labor Center’s recent report Civil Service Vacancies in California 2022-2023 highlights the local effects of California’s statewide government staffing crisis. We found vacancy rates in several counties as high as 30% across wage levels and occupations. Similar vacancy rates have been reported in cities, school districts, and state agencies. As a result, Californians have had to wait longer for basic public transactions, struggled to access critical services, and footed the bill for overtime and outside contractors to perform work normally performed by public employees. Public workers face higher workloads, mandatory overtime, and the stress of trying to provide services in a chronically understaffed environment. Workers testified to state legislators in 2023 about how understaffing, the high cost of living, and slow hiring efforts undermine morale, further damaging efforts to attract and retain vital public workers. Governor Newsom has included the elimination of vacant positions as part of a proposed $8.5 billion in spending reductions in the 2024-25 budget cycle. Many local governments have announced hiring freezes and are targeting vacant positions for reductions. These cuts come as federal pandemic recovery funds are expiring and revenue recovery is stalling in many places, student loan payments resume, and renter protections expire. The state can’t afford to ignore the pressing challenges of staff shortages in its efforts to resolve the budget deficit. The health of the state’s economy requires adequate public sector staffing, especially during economic downturns and recoveries. How did we get here? Without comprehensive data, untangling the many causes of high vacancy rates is difficult. Unfortunately, most government agencies lack systematic data on how long it takes them to post and fill positions, which occupations are hardest to fill, how applicant pools have changed, and other important metrics. The tight labor market of the past three years has produced smaller applicant pools, driven up private sector wages, and increased turnover as workers enjoy more opportunities. Since 2010, private sector wage growth each month—while still well below inflation levels—has significantly outpaced that in the public sector, in contrast to the 2008 Great Recession when public sector wages remained relatively stable. A record low ratio of job seekers to openings leaves employers to compete for a smaller pool of workers. California’s population has declined since 2020 for the first time in the state’s history, and the working-age population is projected to decline steadily over the coming decade. But the tight labor market and wage competition are not the only drivers of staffing challenges. Many occupations had a dwindling pipeline of new entrants long before the pandemic. Nurse, police, and teacher shortages have long predated the pandemic and have exploded since then. Social workers and mental and public health staff were already in short supply before the expansion of mental health programs in schools and counties exacerbated the gap in need. Staffing shortages are also the product of decades of austerity. Beginning with the adoption of Proposition 13 in 1978, California has a long history of underfunding public services and of cutting services during downturns without later restoring them. The long stretch of employment decline after the Great Recession, frozen government salaries and hiring freezes, followed by massive job losses in early 2020, drove many government employees to the private sector or early retirement. This steady chipping away of public budgets (including wage and hiring freezes during the pandemic) has deteriorated the job quality for workers who remain. As of November 2023 there are 35,800 fewer people working in local government than in February 2020. By comparison private sector employment in California has recovered well, growing by 3.5% over the same period. What can government do? Systemize and publish data on vacancies: Data on compensation, hiring processes,…

What Workers and Unions Stand to Gain from Recent Executive Orders on Artificial Intelligence

Given the glaring absence of national legislation in the U.S. regulating new technologies, the recent release of several executive orders on artificial intelligence (AI) at the federal level and in California is significant. President Biden’s executive order in particular is effectively the first national public policy on AI to be established in this country. Moreover, these orders have the potential to result in concrete progress on protecting workers and ensuring they benefit from emerging digital technologies. That potential stems not just from the government’s regulatory power but also from its large footprint as a purchaser of technology, a contractor with private sector businesses, and a provider and funder of public services.We believe that governments at all levels should play an incisive leadership role in establishing robust standards around the use of AI and other digital technologies, prioritizing the safety and well-being of impacted communities—especially low-income communities and communities of color—as well as public sector workers and other workers connected to public funding.Moreover, public sector workers stand to play a critical role in safeguarding the public good against potential harms of government’s use of technologies capable of autonomous reasoning and decision making. For this safeguard to be meaningful, workers must have the skills and authority needed to implement accountability strategies, as well as the right to bargain fully over technology design and impacts.Below we outline core principles for how government action on AI can benefit public and private sector workers, and comment on how two recent executive orders reflect those principles. Our goal is to help inform the significant workthat lies ahead for federal, state, and local governments in their efforts to model responsible use of AI.AI in the WorkplaceThe recent executive orders on artificial intelligence by President Biden at the federal level and Governor Newsom in California cover broad ground, outlining potential risks of AI and directing agencies to develop guidelines for responsible use. Impacted communities have a significant stake in how these executive orders are interpreted, including persons in the criminal justice system, patients in the healthcare system, students and teachers in public schools, and the public in general.Workers and their unions have a stake as well. Across the country, employers are increasingly adopting AI and other digital technologies such as electronic monitoring, algorithmic management, and task automation to make a wide range of employment and production-related decisions. These decisions can affect wages, benefits, work schedules, hiring and firing, discipline and promotion, the number and location of jobs, skill requirements, workloads, and workplace health and safety.Moreover, as governments introduce AI and related technologies into work processes, public sector workers will see their jobs fundamentally transformed, affecting the skills required to do their work, their interaction with clients, their autonomy over work products, and more. Research is raising concerns about negative impacts on mental and physical health, blurring of boundaries between home and work, invasions of worker privacy, inadequate training supports, and difficulty maintaining service quality when new technologies are rolled out. Introducing advanced technologies such as AI can exacerbate power imbalances in the workplace, leaving workers struggling to understand, challenge, or explain outcomes of algorithmic decision making. Finally, the efficiencies and cost savings enabled by technology may not accrue to workers, even as their jobs become less secure, more intense, and are paid less.Government Strategies to Ensure Responsible Workplace Tech1. Leverage the full scope of government spending to promote responsible use of AIDiscussions about government leadership on AI often focus on procurement as an important site for responsible use standards. But the net should be cast wider: federal, state, and local governments should leverage all of the avenues where…

California’s teachers are fighting for better schools

In an extraordinary year for labor, California’s teachers have been at the center of a revitalized movement that has successfully demanded better working conditions, family-supporting wages, and a seat at the table for important educational decisions. The toll taken by the COVID-19 pandemic, the stress of working in an increasingly strained education system, persistent state underfunding, and inadequate salaries and staffing have all invigorated teachers’ unions to fight for their members and their students. In early December, the Legislative Analyst’s Office issued a stark estimate of the state’s fiscal situation heading into 2024-25, which means teachers will once again need to fight alongside families and students to stave off huge cuts in K-12 funding.This fall, tens of thousands of teachers and school workers in Fresno and San Francisco won significant wage increases and more resources for their students. Both unions voted overwhelmingly to strike, but settled their contracts without walking out. These contract wins come on the heels of an Oakland teachers’ strike and Los Angeles educators’ solidarity strike with school workers last year and a Sacramento educator strike in 2022. Pre-pandemic strikes by Los Angeles and Oakland teachers that began the wave in 2019 included big wins for students, school staff, and the broader community. Now, instructors at the California State University system are on strike for similar reasons.Teachers’ willingness to strike represents not just a resurgence of union power, but also their determination to call attention to the dire consequences of decades of California’s underinvestment in K-12 education. The debate over K-12 education often frames school budgets as a zero-sum choice between teacher pay, student needs, and fiscal solvency. But this is a false tradeoff—the challenges facing California’s education workforce and its students have been fueled by the state’s persistently inadequate funding. The damage done by Proposition 13 property tax reform over the last 45 years has never been overcome—changes to the state’s formula for funding education have simply redistributed a pie that is too small.As federal pandemic stimulus money runs out and state revenues decline precipitously, the structural inadequacy of California education funding is again jeopardizing the state’s students. Districts—which must adopt three-year budgets that show a minimum level of reserves—are threatening layoffs and program cuts even as they struggle to attract and retain qualified teachers and address persistent achievement gaps. These funding constraints come as the state should be investing more in education to address both the consequences of the pandemic disruptions and significant vacancy challenges across the state.For years, California has ranked near the bottom of the nation in its investment in K-12 education when adjusted for cost of living. Teachers, parents, and community groups, anchored by the grassroots alliance California Calls, attempted to address this longstanding crisis with a 2020 proposition ballot measure to reform the state’s commercial property tax system. Unfortunately, voters very narrowly rejected the measure. The impacts of this underfunding on students are measurable: California’s high school graduation rate is 23rd in the nation despite having one of the lowest graduation requirements.[1] California students test well below the national average on standardized tests and have some of the largest average class sizes in the country. The state faces persistent inequities in education outcomes that affect future economic wellbeing: 20% of Black students and 15% of Latino students did not graduate high school in 2021.This underfunding is one cause of persistently low pay for all school employees. Teachers across the country are underpaid relative to workers with similar levels of education and experience by an estimated 14%, and California is no exception. More than half of California’s teachers have at least a master’s…

Public spending must support everyone, not just the rich

Americans occupy increasingly separate economic spheres. Each year, more Americans struggle to afford housing, access quality education, pay for health care, and retire above poverty. A majority of Americans lack enough savings to weather a short spell of unemployment or a costly car repair. Our schools are more economically and racially segregated now than in the 1950s. Gaps in access to the Internet, paid sick leave, remote work, and health insurance have been ruthlessly exploited by the pandemic. Meanwhile, the vast majority of public spending — especially tax expenditures — benefits households in the top 20%, who hold nearly 90% of the nation’s wealth. Democrats have perpetuated this distortion; Biden’s tax pledge defines “middle class” as households earning up to $400,000 — the top 1.8% of taxpayers. Services on which most Americans rely — mass transportation, unemployment insurance, public schools, Social Security — have been steadily undermined with little fanfare. Anti-poverty policies do just enough to keep people from the brink. Wealth begets wealth, blessed by the federal tax code. If we are to sustain a meaningful democracy, the Democrats need a compelling campaign to fix our public spending so that it supports the majority of Americans on whose backs the economy has been resting. From Berkeley News, January 22, 2021: Berkeley scholars: Here’s what Biden should accomplish right away

How is this recession different from all other recessions?

I spoke with an sfgate.com reporter recently about how the COVID-19 crisis could impact Bay Area local governments. As always, there is a lot I said that didn’t make it into the article so here’s a bit longer ramble. I’m working on updating the numbers and data underlying these thoughts, so this is just some general concepts we should be thinking about. How is this recession different from all other recessions? The short answer is that every recession is different from every other recession—people (ahem, economists) tend to greatly overestimate our ability to predict how recessions and recoveries will unfold based on previous experience. The recovery from the Great Recession was quite different from previous recoveries (tl;dr: terrific stock market performance but very unsatisfying labor market performance from the perspective of workers). People with far greater expertise in labor economics / macroeconomics have already discussed how this crisis may unfold, although I think we really are in some uncharted territory here. The key differences I see as relates to local government impacts include: 1. The impetus The immediate trigger for the current slowdown is a public health order that has forced businesses across the economy to abruptly cease or reduce activity, regardless of their economic soundness. The Great Recession had several drivers, including inflated property values, complex financial instruments, stagnant wages suppressing actual consumer buying power, etc.—this all came to a head when financial markets famously collapsed in 2008, but many local governments had been seeing revenue slowdowns in the preceding months. In the current recession, the impetus is much more abrupt and steeper, although some of the underlying economic factors may impact the depth of recession and the recovery. The overall stagnation / decline of consumer power and labor market precarity is higher by some measures than before the Great Recession, but the immediate impetus for the slowdown is a public health order, which means that revenues will drop *very steeply* and that many businesses which were fundamentally sound and prospering in February will not exist in June or whenever the economy reopens. The consumer buying power that drove their revenues won’t have evaporated, but the businesses themselves simply won’t have the cash flow to stay alive. This all has implications for the timing of revenue losses and when / how we should expect to see revenues recover. (And of course, people work for those businesses, so the cycle of unemployment and business failure will repeat itself over the coming months.) 2. Uncertainty All recessions bring uncertainty about when the end will come, what recovery will look like, how people and firms and governments will respond, and how those responses will weave together and feed off each other. In this case, the uncertainty is also driven by scientific uncertainty: how quickly a vaccine can be produced. These scientific and behavioral and social uncertainties add a level of complexity specific to this circumstance. 3. The spending impact: In any recession, the biggest challenge governments face is declining revenues at a time when governments should be spending more money: on unemployment insurance, food aid, income supports, etc. COVID-19 has perhaps made this doubly true: we have unexpected costs managing a public health crisis, paying for scarce medical supplies, setting up temporary hospitals, closing up public parks, policing public health orders, housing vulnerable residents, along with all of the income support and other spending that accompanies an economic downturn. These spending imperatives to protect human life and health are atypical, and the federal government’s inaction (along with our complex healthcare system) make it very hard to estimate the total volume and distribution…

Beyond austerity

I started this blog—and chose the name—several years ago while finishing my dissertation. My intent was to write about my research on the shrinking public sphere and the persistent narrative of scarcity that characterizes governance in the U.S. I called it "beyond austerity" because I thought most scholarship on austerity was simplistic and that we needed to think about austerity more broadly. How do communities, and societies, decide what is enough? What constitutes plenty, or luxury? What do we each really need to thrive as individuals? How does it happen that music or art become seen as frivolous, rather than necessities? How do discussions about taxes reflect profound differences in how people think about security and relationships? How do we each normalize the amount of eduction, or money, or clothing, or healthcare, that we are entitled to, or that we resent others having? I began with an academic interest in how austerity is produced: who makes decisions about how to make do with less. Today, these questions are more pressing for me personally (being on a school board these days is all about implementing austerity). I decided to resurrect this site a few weeks ago because a job change gave me more time to write about how much our society reflects the weird combination of scarcity and plenty, and my own experiences observing how society is made up of so many invisible individual contributions—the "public" is so much more than government. And then the coronavirus pandemic took hold here in California. The Bay Area is less than a week into a full-scale shutdown, and every public entity is bleeding revenue: bus systems, BART, bridges, and soon local and state tax systems as incomes drop and the impact of reduced consumption decimates sales taxes. The importance and fragility of our public sector have been thrown into stark relief, as have the web of individual actions that keep our private sector—our restaurants, bookstores, volunteer programs—alive. How will this crisis make us think differently about what we each need to survive? About what, and who, is vital to a functioning society? About what is not necessary to keep our bodies alive, but is necessary for our spirit? And so for day one of this resurrection, I offer a possible answer to the latter:Participatory Budgeting: not just for regular budgets

The Participatory Budgeting Project has a guide for communities that want to participate in decisions about the use of funds from Tax Increment Financing districts. The governance structure associated with Tax Increment Financing varies by state (and not all states have TIF), but there are potentially significant amounts of funding at stake. TIF districts capture the increased property tax increment in a set geographic area and use it to finance private or public projects. They use of funds often lacks transparency, and is often predetermined when the district itself is created. I’ve been following the move to participatory budgeting for a while, and this is an important acknowledgement by PBP that a lot of public money is outside even the difficult-to-engage standard budgeting process. Download their guide here: PB with Tax Increment Finance Funds

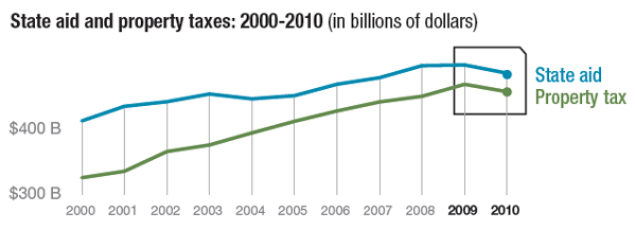

Why is recovery taking so long—and who’s to blame?

We are enduring one of the slowest economic recoveries in recent history, and the pace can be entirely explained by the fiscal austerity imposed by Republican members of Congress and also legislators and governors at the state level. EPI’s Josh Bivens examines the reasons beyond our slow economic recovery (one that has progressively slowed with each recession). Given the degree of damage inflicted by the Great Recession and the restricted ability of monetary policy to aid recovery, historically expansionary fiscal policy was required to return the U.S. economy to full health. But this government spending not only failed to rise fast enough to spur a rapid recovery, it outright contracted, and this policy choice fully explains why the economy is only partially recovered from the Great Recession a full seven years after its official end. The question of why the economic recovery has been so tepid is a vital part of the presidential election discourse. Clinton says she will increase employment through a public investment program. Trump says he will cut taxes to spark employment growth (and further limit spending). Bivens argues that it’s federal policymakers who are most to blame, since structurally only the federal government can maintain spending levels in the face of revenue declines (through monetary policy and debt increases). State and local governments lack these tools (with some caveats around borrowing). But I think this lets state and local officials off too easily; many of them also embraced austerity as reason for pushing through tax cuts that will be almost impossible to reverse. And state lawmakers (which control the revenue options available to cities) lacked the courage to grapple with structural fiscal issues that each recession has made progressively stark. Source: Why is recovery taking so long—and who’s to blame?

From the annals of state austerity budgets…

To the Editor: Thank you for your editorial about Illinois and Kansas as examples of states where policy makers do more harm than good (“Sorry Tales From Two Statehouses,” April 25). Illinois’ record 10-month budget impasse is eroding much of its educational and social service systems. According to a poll of 444 Illinois social service providers, 85 percent are scaling back on the number of clients they serve.At least 3,200 homebound seniors have lost home-delivered hot meals. Service agencies have laid off experienced and talented staff members, perhaps never to get them back. Lutheran Social Services of Illinois, the state’s largest social service provider, announced that it would cut 43 percent of its work force. And all 29 Illinois agencies serving sexual assault survivors have instituted furloughs or left unfilled positions vacant, leaving survivors without essential services. The damage is permanent, not easily or perhaps ever remedied. Even when funding is restored, we won’t simply return to business as usual. Ours is a real-life example for governments considering a similar path. JOHN BOUMAN President, Sargent Shriver National Center on Poverty Law Chicago Source: Drastic Cutbacks in Illinois – The New York Times

Welfare and the politics of poverty

Great recap of the welfare reform travesty – in which Clinton admits that the poorest families in the U.S. are worse off after welfare reform. Also describes how state control, combined with fiscal downturns, pulled money away from the poor.

Water woes could sink Flint’s property values even more

The situation in Flint only gets worse: not surprisingly, residents are now worried about their property values, which have already fallen significantly over the past decade. The inability of many residents to sell their homes will only get worse as the reputation of the city’s water supply plummets. This means not only an ongoing crisis of lack of mobility for the city’s residents, who might want to move to better work opportunities, but a looming crisis for city’s already decimated property tax base. Residents will certainly request reassessments of their property values, which are tied to the true cash value of the home. “Given what’s going on there, I’d have to imagine there’s a plummeting in the fair market value,” said Nathan Resnick, a Bloomfield Hills lawyer who specializes in tax appeals and real estate law. “There’s going to be disparity” between what assessors say the properties are worth and what buyers are willing to pay. Morse said lenders are already skittish about lending in Flint and are asking appraisers to find comparable homes that have sold very recently rather than, say, eight months ago.”Eight months ago was a completely different market than what’s going on now,” Morse said. Source: Water woes could sink Flint’s property values even more Al Jazeera has also covered the story: https://twitter.com/ajam/status/718246152693374976

Defending public pensions

I’ve written a lot about how public pensions came to be blamed for the fiscal crisis looming (or already “crippling”) many cities and states. The National Public Pension Project has been working since 2007 to change the narrative about the value of public pension plans, and has an interesting website and blog. NPPC believes every American should be able to retire in dignity. We also know that there is no one more interested in strengthening the public pensions system than the public employees who are counting on pensions to retire. After all, public pensions are the only source of retirement for 30% of public employees since they do not receive Social Security. Pension plans also play a vital role in decreasing poverty among older Americans, according to the National Institute for Retirement Security. Across the country, public employees – who have faithfully contributed their life savings into the pensions systems — are at the mercy of public officials unfairly targeting their financial security for political gain. The NPPC is working to preserve the financial security of all workers for generations to come. Follow their blog or check them out on twitter: Got pension questions? We have answers! Tweet us & we’ll answer on the blog https://t.co/qsXRNlxXNx pic.twitter.com/cB8BVuvHvH — National Public Pension Coalition (@ProtectPensions) April 8, 2016

Crowdfunding for the Public Good Is Evil | WIRED

Important article about the slippery slope from an underpaid teacher crowdfunding for classroom supplies to a bankruptcy city crowdfunding to clean up its parks. Crowdfunding is great when it funds new products that aren’t getting supported by more conventional forms of investment: Public necessities, by contrast, are not awesome; they’re essential. Roads, health care, education: These are not the kinds of things that go viral and raise $2 million in less than a week. But if crowdfunding for the public good is allowed to continue unchecked, it’s not hard to imagine a future in which everyone votes on public works with their dollars—distorting priorities and giving those with deeper pockets more of a say. Of all the crowdfunding appeals I’ve come across on facebook, a solid 90% of them are for healthcare expenses (and more often than not for dire conditions, like cancer or a terminal genetic disease). This is depressing not just because healthcare is also a public good (and these appeals make clear the inadequacy of our healthcare funding structure), but because it puts people in the position of begging for money at the most desperate time in their lives. Their very survival is now hitched not just to their own healthcare-employment situation, but to the wealth of their family members, classmates, and facebook connections. I’d like to call that evil too. Source: Crowdfunding for the Public Good Is Evil | WIRED

BART gets real

Infrastructure may not be sexy, but you tend to notice when it crumbles around you. BART has been having all kinds of problems lately, and its twitter account manager isn’t pulling any punches. @tquad64 Planners in 1996 had no way of predicting the tech boom – track redundancy, new tunnels & transbay tubes are decades-long projects. — BART (@SFBART) March 17, 2016 @jalrobinson At the end of the day, we're just trying to illustrate the importance of public transit to the Bay Area – and America. — BART (@SFBART) March 17, 2016 @cliberti We have 3 hours a night to do maintenance on a system built to serve 100k per week that now serves 430k per day. #ThisIsOurReality — BART (@SFBART) March 17, 2016 We want semi-decent infrastructure without all the boring planning and funding that requires. Anyone who’s ridden a fixed rail system anywhere outside the U.S. has to suppress the shame of realizing your own country’s efforts at transportation are like a child’s haphazard train set. Do we care enough to fix it? Source: San Francisco’s transit system stopped being polite and got real about complaints on Twitter

When universities go bankrupt…

LSU and many other public colleges in Louisiana might be forced to file for financial exigency, essentially academic bankruptcy, if state higher education funding doesn’t soon take a turn for the better. Louisiana’s flagship university began putting together the paperwork for declaring financial exigency this week when the Legislature appeared to make little progress on finding a state budget solution, according to F. King Alexander, president and chancellor of LSU. “We don’t say that to scare people,” he said. “Basically, it is how we are going to survive.” … Being in a state of financial exigency means a university’s funding situation is so difficult that the viability of the entire institution is threatened. The status makes it easier for public colleges to shut down programs and lay off tenured faculty, but it also tarnishes the school’s reputation, making it harder to recruit faculty and students. … Lawmakers have yet to move any revenue-raising measures — either a tax hike or tax credit rollback — during the session. A Senate Finance Committee is scheduled to take up an inventory tax repeal Wednesday afternoon (April 22) that would produce additional revenue for the state, though passage is far from certain.

The Glitch in Colorado’s Weed Experiment – NYTimes.com

To be filed under the “be careful what you wish for” category of fiscal policy. Colorado scrambles to avoid having to refund all of the revenue from marijuana sales, because, well because SMALL GOVERNMENT! As an April 1 report in The Times explained, Colorado’s tax revenues have recently surged, thanks in part to the booming construction, oil and gas industries, in addition to some $58 million from the marijuana taxes. But not only revenues but overall state spending this year are expected to end up higher than the state estimated back when the marijuana tax was on the ballot. Under Tabor — which some in Colorado have likened to a fiscal straitjacket or a statutory version of the crazed space computer HAL 9000 — the state is therefore required to refund the marijuana money. It will be interesting to see how this turns out. Legislators are trying to pass a law that would get around this, but the constitutional amendment still stands, until voters agree to repeal it. Read: The Glitch in Colorado’s Weed Experiment – NYTimes.com.

The federal budget, battleground

So much to say about Obama’s budget, the geek in me actually wants to read the entire plan, but I have this pesky dissertation to finish instead. Budgets are inherently redistributive documents, in one direction or another. Obama’s proposal is being characterized as a bold effort to redistribute the benefits of the recovery to the middle-class. It may be that, at least in part, but that could mean a lot of different things to different people. One sentence that caught my eye is that Obama has left out “any pretense of trying to address the main drivers of the long-term debt – Social Security and Medicare.” And that he has outlined an ambitious set of goals rather than remaining “hemmed in… because of politics and balance sheets.” I’m not entirely sure what the NYT is getting at (that fixation on “entitlement” programs and debt is responsible for the absence to date of bold budgetary goals? what’s changed?). I look forward to these debates if indeed the (or any!) Democrats really stand up for the idea that government can do good, but that government has recently been redistributing wealth from the bottom and middle to the top. There’s a lot of deconstructing to do of the term “middle-class” and of “redistribution.” The government is always in the business of spreading wealth, the question is who wields the butter knife. Read: In Budget, Obama’s Unfettered Case for Spreading the Wealth – NYTimes.com.

Greek voters reject austerity

The Syriza party wins a major victory in Greece, forming an alliance with right-wing opponents to austerity (or, more specifically, to following the orders of Germany and the EU). I wish I had time to read much more about what’s happening in Europe, so I’ll just have to save it for summer beachside reading, post-dissertation. Mr. Tsipras’s victory represented a rejection of the harsh economics of austerity. It also sent a warning to the rest of Europe, where continuing economic weakness has stirred a populist backlash, with more voters growing fed up with policies that have required sacrifices to meet the demands of creditors but that have failed to deliver more jobs and prosperity. … “The Greeks have the right to elect whoever they want; we have the right to no longer finance Greek debt,” Hans-Peter Friedrich, a senior member of Ms. Merkel’s conservative bloc, told the daily newspaper Bild on Monday. “The Greeks must now pay the consequences and cannot saddle German taxpayers with them.” Read: AfterVictoryatGreekPolls, AlexisTsiprasIsSwornInandFormsCoalitionGovernment-NYTimes.com.

Informal Economy Budget Analysis

I just stumbled across this concept today (during the San Francisco Bay Area superstorm!): Informal Economy Budget Analysis. Pioneered by Women in Informal Employment: Globalizing and Organizing (WIEGO). In their words: Informal Economy Budget Analysis (IEBA) examines how government budgets address the needs and interests of different groups of informal workers. It also investigates what opportunities exist for informal workers (or their representatives) to participate at different stages of the budget process. IEBA was developed and tested in South Africa by Debbie Budlender, Francie Lund, Caroline Skinner, and Imraan Valodia as part of the Durban Informal Economy Policy Process: see Durban Informal Economy Policy Process. In 2009, WIEGO commissioned the analysis of government budgets from an informal economy perspective under the technical guidance of Debbie Budlender in one city in each of four places: Belo Horizonte in Brazil, Lahore in Pakistan, Metropolitan Lima in Peru, and Quezon City in the Philippines. I found out about it from the Inclusive Cities people. They have several links to WIEGO papers here. Excited to check this out. I’m not focused on the informal economy, but I like the idea of alternative budget analysis.

Watchdog: Borrowing Trouble – Chicago Tribune series

A great series finished last month on the Chicago Public Schools district’s engagement in complex bond deals, the lack of public oversight, and the high costs of many of those deals. I’ve been researching interest rate swaps for over a year, and I’m impressed with the thoroughness of the reporting here. THIS is why we need robust and well-staffed public newspapers. Read: Watchdog: Borrowing Trouble – Chicago Tribune. (I’m not sure how much is behind a paywall)

Detroit loses power, literally.

Detroit — A widespread power outage Tuesday that caused evacuations of buildings throughout downtown is “another reminder of how much work we still have to do to rebuild the city,” Mayor Mike Duggan said. Duggan, speaking at an afternoon press conference, said Detroit is in the early stages of a four-year, $200 million plan to upgrade the city’s electrical grid, which has not been modernized in decades. The outage, which started around 10:30 a.m., darkened traffic lights and buildings on the city’s municipal power grid, including hospitals and fire stations. Nine hundred “customer locations” and 740 traffic signals were affected, the city said. The city did not lose 911 dispatch service. All outages should be restored by late tonight, DTE officials said. They said the cable failure that caused Tuesday’s outages are not uncommon in large urban centers like Detroit. “This situation is not going to slow down our efforts to … restore the city,” council President Brenda Jones said. City officials said the city’s public lighting grid suffered a “major cable failure” that caused power to be lost at Joe Louis Arena, Coleman A. Young Municipal Center, the Frank Murphy Hall of Justice, the Detroit Institute of Arts and some buildings at Wayne State University. Power has since been restored in many areas, including City Hall and Detroit Receiving Hospital. Hospitals, that lost power operated on backup generators, city officials said. Read: Duggan on power outage: City still has work to do.

News of the unsurprising: tax cuts lead to budget deficits

November 18, 2014 – RALEIGH, N.C. North Carolina lawmakers are likely enjoying some downtime after the legislative session and midterm election, but experts predict a tough session waiting for them on their return to Raleigh. A report from the Office of the State Controller indicates tax revenues are down by almost $400 million compared with this same time last year – a six percent drop in revenue. Alexandra Sirota, director of the North Carolina Budget and Tax Center, says it’s not a problem the State Assembly will be able to ignore in January. “This is a serious issue,” she says. “It’s self imposed in that policymakers chose to reduce our revenue. Now they’re going to have to make choices about some pretty deep cuts.”

Kansas cuts taxes, guess what happens next?

There may be even bigger challenges coming. In addition to the likelihood the state will face another unpleasant revenue surprise in the spring, a pending court decision could obligate the legislature to add hundreds of millions of dollars a year to state aid to school districts. And bond rating agencies, which already downgraded the state’s debt this year, could be expected to react negatively to both of those events. The tax cuts were the leading issue in the Kansas governor’s race this year, and in addition to re-electing Governor Brownback, voters expanded the Republican supermajority in the state’s House of Representatives. This was a clear mandate for the policy of deep tax cuts. What remains to be seen is how the legislature, once the rainy-day fund is exhausted, will deal with the spending pressures they have created. Read: Kansas Announces Big Budget Gap; True Gap May Be Even Larger – NYTimes.com.

IMF critiqued internally for austerity response

BY ANNA YUKHANANOVWASHINGTON Tue Nov 4, 2014 Reuters – The International Monetary Fund ignored its own research and pushed too early for richer countries to trim budgets after the global financial crisis, the IMFs internal auditor said on Tuesday. The Washington-based multilateral lender, concerned about high debt levels and large fiscal deficits, urged countries like Germany, the United States and Japan to pursue austerity in 2010-11 before their economies had fully recovered from the crisis. At the same time, the IMF advocated loose monetary policies to sustain growth and boost demand in advanced economies, initially ignoring the possible spillover risks of such policies for emerging market countries, the Independent Evaluation Office, or IEO, said in a report that analyzed the IMFs crisis response. “This policy mix was less than fully effective in promoting recovery and exacerbated adverse spillovers,” the IEO wrote. The IMF advises its 188 member countries on economic policy, and provides emergency financial assistance to its members on the condition they get their economies back on track. The internal auditor said the IMF should have known that the combination of tight fiscal policy and expansionary monetary policy would be less effective in boosting growth after a crisis. Evidence showed that the private sectors focus on reducing debt made it less susceptible to monetary stimulus. In 2012, the IMF finally admitted that it had underestimated how much budget cuts could hurt growth and recommended a slower pace for austerity policies. But its auditor said the IMFs own research showed this relationship even before the crisis. Read: IMF gave richer countries wrong austerity advice after crisis – watchdog | Reuters.

We’re not in Kansas anymore – or are we?

Great clip from the Daily Show about tax cut strategies gone wrong, prompting Kansas Republicans to endorse the Democratic opponent of Sam Brownback, the current Republican Governor. The Daily Show Get More: Daily Show Full Episodes,Indecision Political Humor,The Daily Show on Facebook

“The Social Geographies of Recession and Austerity”

I just stumbled on this great list of resources from early this year, on a blog by Alison Stenning: Some really great blogs have emerged over the past few years as people have tried to document their own, and others’, struggles with austerity. There’s an article about some of these blogs here. These are some of the most interesting and/or prolific: http://agirlcalledjack.com – Blog by Jack Monroe who has published particularly about food and food poverty; her Guardian columns (and recipes) are available here:http://www.theguardian.com/profile/jack-monroe http://katebelgrave.com – “Talking with people dealing with public sector cuts”. Kate Belgrave’s Guardian columns are here: http://www.theguardian.com/profile/kate-belgrave http://mumvausterity.blogspot.co.uk – Bernadette Horton, “a mum of 4 fighting everyday battles against austerity – and hoping to win!” Most of these bloggers also tweet; you can find them and follow them for more updates and links to other bloggers. Many of the major newspapers have developed sub-sections on their websites in which they document the effects of austerity from a number of perspectives. On Guardian Witness, you can find personal accounts of families living in poverty; you follow the link to Guardian Witness from this page. The Guardian is also home to Patrick Butler’s Cuts Blog. In 2008, The Telegraph’s went on a ‘Recession Tour‘ of a variety of UK localities. Much of the material that ends up on the (web)pages of our national newspapers comes from a range of different projects launched by a variety of think tanks, lobby groups, charities and so on. The projects I’m highlighting here are ones which focus on the everyday experiences of recession and austerity in communities. Real Life Reform is “an important and unique study that tracks over a period of 18 months how people are living and coping with welfare reforms across the North of England”. It has been developed by the Northern Housing Consortium with seven northern housing associations. There are two reports, one from September 2013 and another from December. A third report is due in the spring of 2014. You can follow Real Life Reform on Twitter @RealLifeReform. The IPPR have developed a Voices of Britain website (http://voicesofbritain.com), as a ”snapshot of the condition of Britain in 2013”. The Family and Parenting Institute’s work on Families in the Age of Austerity is another exploration of the effects of austerity on families. The Campaign for the Elimination of Discrimination against Women (CEDAW) Working Group for the North East produced this report on the impact of austerity measures on women in the North East. For an Irish perspective, have a look at http://irelandafternama.wordpress.com – a blog written mostly by geographers on Ireland’s experience of financial crisis and austerity. Head to the blog for the rest of the post, which also has links to academic works on austerity: The Social Geographies of Recession and Austerity | researchingrelationships. Also check out her own post about the costs of Austerity in Britain: https://blogs.ncl.ac.uk/alisonstenning/the-costs-of-austerity/ Looks like she isn’t writing more, but always nice to find someone with kindred interests…

The Body Economic: Why Austerity Kills

Subtitle: Recessions, Budget Battles and the Politics of Life and Death. By David Stuckler and Sanjay Basu —thebodyeconomic.com This book came out in 2013, and is frequently cited in discussions of austerity and the damage – short- and long-term – resulting from budget cuts, particularly at the national level. The book is organized in three sections: History, The Great Recession, and Resilience. The book focuses on the health impacts of budget cuts: not just cuts to health programs but broadly conceived impacts of austerity. The book begins by describing the New Deal’s response to the Great Depression in the U.S., to the bump in mortality following the collapse of communism in the Soviet Union (driven by stress, alcohol, despair, and poor nutrition), and the Asian Financial Crisis. The second and third parts of the book contrast Greece and Iceland (whose leaders rejected the IMF austerity prescription) The authors use a combination of health data and reviewing economic data and public policy. Analyzing health indicators along with economic ones is an important, but difficult, endeavour. Questions of causality and of data quality dog any enterprise like this, and would be enormously difficult at a sub-national scale. (I once spent months trying to figure out how to measure access to healthcare in U.S. suburbs, and eventually abandoned the effort). There may be many other explanations for the difference between Greece – plagued by suicides and an HIV epidemic after EU-imposed austerity – and Iceland. The authors’ valiant and unsuccessful effort to get Greek politicians to take action on the spike in HIV – which they link to rising heroin use, unemployment, and the end of needle-exchange programs – raises questions about the relationship between multinational governance, local democracy, and science that can’t be simply answered. But the overall claims are well argued and documented, and bolster a hypothesis that most people would agree with on its face: a poor economy fuels poor health. Of course, so can a growing economy, as evidenced by the U.S. The book’s U.S. segment features a common story of deferred healthcare leading to avoidable personal tragedy. The U.S. healthcare system has failed its citizens in good times and bad, but in recession more people may take such terrible gambles. This chapter is in the section on resilience, along with a chapter on the relationship between suicide and unemployment, and a chapter on U.S. homelessness that documents the rise of West Nile disease carried by mosquitos thriving in the pools of foreclosed and abandoned homes. There is an anecdotal feel to the book, but many of the stories provide a compelling illustration of the misguided approaches to economic crisis that dominant the U.S. and Europe, and the way that austerity can backfire. It would be great if this study fuels more research into the relationship between health and public spending, especially research that moves beyond anecdotes and enables broader policy recommendations for public health spending in times of both boom and bust.

Suburban austerity

Five decades after President Lyndon B. Johnson declared a war on poverty, the nation’s poor are more likely to be found in suburbs like this one than in cities or rural areas, and poverty in suburbs is rising faster than in any other setting in the country. By 2011, there were three million more people living in poverty in suburbs than in inner cities, according to a study released last year by the Brookings Institution. As a result, suburbs are grappling with problems that once seemed alien, issues compounded by a shortage of institutions helping the poor and distances that make it difficult for people to get to jobs and social services even if they can find them. In no place is that more true than California, synonymous with the suburban good life and long a magnet for restless newcomers with big dreams. When taking into account the cost of living, including housing, child care and medical expenses, California has the highest poverty rate in the nation, according to a measure introduced by the Census Bureau in 2011 that considers both government benefits and living costs in different parts of the country. By that measure, roughly nine million people — nearly a quarter of the state’s residents — live in poverty. The New York Times looks at suburban poverty in California, mentioning the lack of social services in the suburbs, but doesn’t dig too deep. I worked on a research project several years ago that asked me to try to conceptualize the material difference in suburban versus urban poverty. Many fine-grained indicators of financial insecurity are hard to map at a sub-metro level: health insurance, use of food stamps, etc. Although there has been a boom in literature about suburban poverty (and a hearty anecdotal understanding across the country that poverty is not an inner city issue), I haven’t seen much in the way of robust research on what this means for policy. This article is an example of a description that surprises less than it seems to think it will, and raises fewer questions than it should: Why don’t those suburbs, in some cases huge municipalities, offer services? Is the reliance on private charity really much higher in the suburbs, or are urban residents also drawing heavily on them? Researchers and journalists, take heed! Read: Hardship Makes a New Home in the Suburbs

The American Middle Class Is No Longer the World’s Richest – NYTimes.com

More and more coverage of American inequality, but I’m curious about how it’s often framed as the disappearance, or decline of the middle class. This article paints an interesting picture of American middle class decline relative to its counterpart in other countries, and paints a picture of economic crisis fueling the relative decline of Americans below the top income percentiles. Stagnant wages (relative to corporate profits) and America’s lost grip on education superiority are mentioned, but the role of government in mediating income distribution is only hinted at. Is this a story of austerity, or economic restructuring, or both? How Americans respond to their growing sense of falling behind, and of their children inheriting lower economic possibilities, will be driven by how they see government’s role in this story. Read: The American Middle Class Is No Longer the World’s Richest – NYTimes.com.

Bailing on Detroit – Jamie Peck

Jamie Peck, Geography professor at The University of British Columbia, has written quite a bit about neoliberalism, what he calls “austerity urbanism” and the ongoing saga of Detroit’s finances. He has an insightful blog post on how terms like bailout, responsibility, and federalism are serving to seal Detroit’s fate as a sinking ship, forced to go under in the name of civic individualism, while the state and federal government stand by and watch. These arguments are perfectly consistent with the conservative legal doctrine of fiscal federalism, where not only “each level of government,” but in effect each unit of government, must “internalize both the costs and the benefits of its activities.”[8] This is the antithesis, effectively, of Keynesian redistribution, with its compensatory fiscal transfers and anti-cyclical stabilizers. In contrast, the neoliberal version of fiscal federalism holds that cities, suburbs, and local-government entities must always be free to opt out, as in the logic of small-government suburbanism,[9] but they must never, in any circumstances, be “bailed out.” This disaggregated, go-it-alone world is a world ruled by fiscal discipline, imposed across different tiers of government and between neighbors; (in)solvency duly becomes, rightfully, a local matter. The new fiscal landscape can be crudely divided between free-riding, low-tax suburbs on the one hand, and indebted (or even bankrupt) cities on the other. In the morality plays of austerity urbanism,[10]“irresponsibility” is perversely conferred on the latter, not the former. Read the rest here: Bailing on Detroit | cities@manchester. And check out many other great entries at cities@manchester

Chicago’s Credit Rating Downgraded by Moody’s – NYTimes.com

The pension battle in Chicago and Illinois will be fueled by Moody’s latest announcement: Moody’s Investors Service downgraded Chicago’s credit rating, citing the city’s unfunded pension liabilities. The agency announced Tuesday it was lowering the rating on $8.3 billion in debt to Baa1, from A3, putting it only three notches above junk status. Moody’s gave Chicago a negative outlook, indicating another downgrade could occur if there is no pension fix. Moody’s says the rating “reflects the city’s massive and growing unfunded pension liabilities.” It says those liabilities “threaten the city’s fiscal solvency” unless major revenue and other budgetary adjustments are adopted soon and are sustained for years to come. The lower rating means the city may have to pay higher interest rates. Moody’s said a commitment to raising tax revenue is a factor that could lift the credit rating. Read: Chicago’s Credit Rating Downgraded by Moody’s – NYTimes.com. Last year, Fitch Ratings downgraded Illinois just days after the state legislature adjourned (May 31) without passing pension reform. After the Governor threatened to withhold legislator salaries until pension reform was passed, the legislature rallied to pass legislation in November that was signed into law December 5, 2013. Litigation over terms of the reform is ongoing. For some local coverage of the “reform” effort in Illinois, go here.

To Pay for Infrastructure Repairs, Obama Seeks Tax Changes

ST. PAUL, Minn. — Caught between a gridlocked Congress and a Highway Trust Fund that will soon be broke, President Obama on Wednesday urged lawmakers to overhaul corporate and business taxes to pay for repairing and replacing the nation’s aging roads, rails, bridges and tunnels. … New legislation to pay for transportation projects is an urgent priority for both parties because the highway fund is nearing insolvency. Anthony R. Foxx, the transportation secretary, has said the fund could begin “bouncing checks” by this summer. That would force a halt to construction projects around the country, officials have said, and could undermine as many as 700,000 jobs. The president’s proposal, which he first suggested in a speech last summer in Chattanooga, Tenn., would eliminate business and corporate tax loopholes to finance a four-year, $302 billion transportation bill. White House officials declined to be specific, but said they would try to eliminate incentives for companies to ship jobs overseas. Read: To Pay for Infrastructure Repairs, Obama Seeks Tax Changes – NYTimes.com.

Woops!

The New York Times gets transcripts of conversations between the economists responsible for guiding the U.S. economy past the financial crisis, and failing. The hundreds of pages of transcripts, based on recordings made at the time, reveal the ignorance of Fed officials about economic conditions during the climactic months of the financial crisis. Officials repeatedly fretted about overstimulating the economy, only to realize time and again that they needed to redouble efforts to contain the crisis. Some of this stuff just gets to depressing to read in its various reiterations, but I did anyway (in no small part because my 7-year-old saw the photo of Geithner, Bernanke, and Paulson on the front of our paper and asked what the story was about.) The fumbling, the over-confidence, the ingrained reluctance to believe that the system could be failing, and the apparent aversion to stimulus (even after things got worse) are all laid out in phone calls and emails. By the end of the year, the Fed had cut interest rates nearly to zero and started to buy mortgage bonds in a further effort to stimulate the housing market and the broader economy. More than five years later, it is still pursuing both policies even as the economic recovery remains incomplete.Some Fed officials have argued that the Fed was blind in 2008 because it relied, like everyone else, on a standard set of economic indicators.As late as August 2008, “there were no clear signs that many financial firms were about to fail catastrophically,” Mr. Bullard said in a November presentation in Arkansas that the St. Louis Fed recirculated on Friday. “There was a reasonable case that the U.S. could continue to ‘muddle through.’ ” Read: Fed Misread Crisis in 2008, Records Show – NYTimes.com.

Michigan has nearly $1B more than expected for budget | Crains Detroit Business

State budgets have been rebounding much faster than most city budgets (for many reasons: spending cuts achieved through attrition are finally appearing on the balance sheet, income taxes have begun to recover faster than housing values, etc.). Accordingly, states that were experiencing “fiscal emergencies” just a few months ago are now facing surpluses as they begin to budget for the coming fiscal year. As could be expected, tax cuts are first on the table (despite the fact that it wasn’t tax increases but spending cuts that contributed most to the surplus). LANSING — Gov. Rick Snyder and lawmakers have nearly $1 billion more than expected when crafting Michigan’s next budget. The Snyder administration and economists today agreed the state will take about $975 million more in tax revenue from last fiscal year through the next budget year than was forecast eight months ago. The debate now will ramp up over what to do with the surplus. Tax cuts, more road repairs and extra money for education are on the table. Read: Michigan has nearly $1B more than expected for budget | Crains Detroit Business. (January 10, 2014)

Pensions for city workers can’t be cut, but pay can, judge rules in major San Jose case – San Jose Mercury News

The fate of San Jose’s pension reforms remains unclear after a recent court decision. SAN JOSE — In a landmark ruling that could help shape city budgets around the state, a judge invalidated key parts of San Jose’s voter-approved pension cuts but upheld other elements that could still save huge taxpayer costs. Santa Clara County Superior Court Judge Patricia Lucas’ tentative decision released Monday prohibits the city from forcing current employees to contribute significantly more toward their pensions, as called for in last year’s Measure B. But the ruling allows the city to cut employees’ salaries to offset its increasing pension costs. … City leaders may find it difficult to go through with the pay cuts, however. The City Council earlier this month approved 10 percent pay raises for cops, after police officers began fleeing the department for better-paying cities. The cop exodus has coincided with a huge increase in crime, above the California and national averages, while arrests have dropped in half in recent years. Read: Pensions for city workers can’t be cut, but pay can, judge rules in major San Jose case – San Jose Mercury News.

Police Salaries and Pensions Push California City to Brink – NYTimes.com

A California city that filed for bankruptcy in 2001 after a developer secured a $10 million judgment against it, Desert Hot Springs was featured in the NYT for its fiscal troubles. The city, Desert Hot Springs, population 27,000, is slowly edging toward bankruptcy, largely because of police salaries and skyrocketing pension costs, but also because of years of spending and unrealistic revenue estimates. It is mostly the police, though, who have found themselves in the cross hairs recently. “I would not venture to say they are overpaid,” said Robert Adams, the acting city manager since August. “What I would say is that we can’t pay them.” Public safety was once considered a basic urban service – perhaps the primary reason for incorporation. Police (and fire) pensions are more costly than others because workers are allowed to retire earlier, and because the city pays into a pension fund instead of social security, for which many public safety retirees are not eligible. It’s not hard use simple figures to paint police benefits as “generous” or “unsustainable,” particular in small, working-class cities like Desert Hot Springs. But the short-term gaps that emerge from bad policy and economic cycles belies the fundamental sustainability of well-managed pension funds over the long-term. The fact that so many cities are being dragged down by pension obligations speaks more to poor management and the ominous fiscal picture of cities in general. Police unions say the fault lies with state and local politicians who failed to adequately fund the pension system over the years, and inflated benefits during boom years. Others wonder whether such salaries and pensions were ever affordable, particularly in cities as small and struggling as this. In Desert Hot Springs, for example, for every dollar that the city pays its police officers, another 36 cents must be sent to Calpers to fund their pensions. Read: Police Salaries and Pensions Push California City to Brink – NYTimes.com.

What Washington Gives New York – Added Strain on the Social Safety Net – NYTimes.com

New York City’s commitment to preserving a social safety net is quietly heroic. When the federal government began slashing last March, officials with the Department of Housing Preservation and Development drained their reserves to keep building housing. They also preserved the rental vouchers that stand between tens of thousands of Lucy Delgados and homelessness. But the protective tarp gets pulled tauter and tauter. “Some tenants face having to move to smaller apartments, and what they pay monthly on rent could go from 30 to 40 percent of their income,” the housing commissioner, RuthAnne Visnauskas, says. “It’s harsh, and a lot of people are unhappy, including us.” Read: What Washington Gives New York – Added Strain on the Social Safety Net – NYTimes.com.

More than one way for a city to die

There has been a lot of press lately, nationally and locally, about the skyrocketing cost of living and doing business in San Francisco. While all that money keeps the city in better fiscal shape than most places in the U.S., it doesn’t necessarily improve the quality of life for San Franciscans. In fact, it kills city life for those residents forced out by evictions and rising rents. It also hasn’t infused money into public infrastructure, as evidenced by the controversy over private bus systems run by Google. “Community space” implies something that is open to, well, the community. Subverting of naming conventions to suggest public access and transparency, while providing neither, is troubling and increasingly pervasive. But this turning inward, despite the incessant drumbeat of “community,” is quickly becoming the rule rather than the exception. In my class on urban economics, we talk about the movement of firms back to central cities, explained by their desire to be near amenities that their workers value (in addition to other benefits of agglomeration economies). But increasingly, these firms then create private amenities out of semi-public spaces, which challenges our notion of what it is that makes cities desirable, to both firms and workers. These are not idle differences: the protests over how tech firms and workers use public space–including both physical spaces and the public spaces of governance. In “The Death and Life of Great American Cities,” Jane Jacobs wrote, “Cities have the capability of providing something for everybody, only because, and only when, they are created by everybody.” We’re losing that here. The further the tech sector gets from the reality of the problems it’s engaging with, the smaller piece of the problem they’ll end up actually fixing. Read: WhatTechHasn’tLearnedFromUrbanPlanning-NYTimes.com.

Report: Detroit bankruptcy caused by state cuts, shrinking tax base, not long-term debt | Detroit Free Press | freep.com

While we wait for the federal judge to rule on Detroit’s petition for bankruptcy, a Demos report enters the fray: WASHINGTON — A New York-based think tank released a report today questioning Detroit Emergency Manager Kevyn Orr’s assertion that the city’s long-term debt is responsible for its fiscal problems, or that pension contributions are at major hurdle for the city’s finances. Instead, the report by Wallace Turbeville, a senior fellow at Demos, a public policy organization, said Detroit’s decline into bankruptcy was caused by a steep decline in revenues partially due both to a shrinking tax base and deep cuts in state revenue sharing with the city. “By cutting revenue sharing with the city, the state effectively reduced its own budget challenges on the backs of the taxpayers of Detroit,” Turbeville wrote. “These cuts account for nearly a third of the city’s revenue losses between (fiscal year) 2011 and FY 2013. … Furthermore, the Legislature placed strict limits on the city’s ability to raise revenue itself to offset these losses.” It says a lot about what’s at stake in Detroit that Demos, an organization committed to reducing political and economic inequality, chose to question the factors that have been blamed for Detroit’s struggles for decades, but especially in the past few years: unions and an “addiction to debt” (Orr’s words). I haven’t had a chance to read the report yet, but I hope it’s able to break some of the conservative grip on the narrative about urban fiscal crisis in Detroit and elsewhere. Read: Report: Detroit bankruptcy caused by state cuts, shrinking tax base, not long-term debt | Detroit Free Press | freep.com.

Peter Marcuse on Participatory Budgeting

I’ve just discovered Peter Marcuse’s blog on critical planning, and the post at the top is on participatory budgeting. Marcuse’s 1981 article “The targeted crisis: on the ideology of the urban fiscal crisis and its uses” has been instrumental in framing my dissertation, so I’m excited to see that he’s turning his attention to city budgets, a topic that gets woefully little attention. I won’t attempt to summarize Marcuse’s comments, it’s worth a full read: Blog #39 – Participatory Budgeting – Potentials and Limits | Peter Marcuse’s Blog.

How Austerity Kills

Over a year ago I saved an article that caught my eye – Businessweek, of all sources, reporting on a study connecting austerity and a spike in HIV in Greece: HIV infections among drug users in Greece jumped more than 20-fold in fewer than two years, fueled by a lack of needle exchange and methadone programs, according to the European Centre for Disease Prevention and Control. The ECDC, the European Union agency that monitors infectious disease, reported 314 cases of the AIDS-causing virus among injecting drug users in the first eight months of this year. That compares with 208 for all of 2011 and no more than 15 cases a year from 2001 to 2010, the ECDC said in today’s report. While the extent to which Greece’s economic crisis has contributed to the outbreak is unclear, austerity measures and high unemployment may fuel new infections in Athens and beyond the capital unless programs to provide methadone, clean needles and condoms are expanded, the Stockholm-based ECDC said. “The current economic turmoil will continue to have adverse effects on HIV prevention not only in Greece, but also in other parts of Europe,” the ECDC said. “The cost of prevention to avert HIV infections will be less than the provision of treatment to those who become infected.” HIV Soars Among Greece’s Drug Users Amid Austerity – Businessweek. This story contrasts with the relative lack of coverage in the U.S. of social service cuts. (I wonder if the CDC here would draw such a connection, between funding and the spread of disease. The report titles on their website are all very dry.) Just this year, a study was published suggesting that people with HIV in London made different treatment choices as a result of economic austerity (their word). And now there is a book out – “The Body Economic: Why Austerity Kills” by economist David Stuckler and physician Sanjay Basu (the authors were recently interviewed by Amy Goodman, which you can read here.) The authors wrote an op-ed in the New York Times last spring about “How Austerity Kills:” If suicides were an unavoidable consequence of economic downturns, this would just be another story about the human toll of the Great Recession. But it isn’t so. Countries that slashed health and social protection budgets, like Greece, Italy and Spain, have seen starkly worse health outcomes than nations like Germany, Iceland and Sweden, which maintained their social safety nets and opted for stimulus over austerity. (Germany preaches the virtues of austerity — for others.) As scholars of public health and political economy, we have watched aghast as politicians endlessly debate debts and deficits with little regard for the human costs of their decisions. Over the past decade, we mined huge data sets from across the globe to understand how economic shocks — from the Great Depression to the end of the Soviet Union to the Asian financial crisis to the Great Recession — affect our health. What we’ve found is that people do not inevitably get sick or die because the economy has faltered. Fiscal policy, it turns out, can be a matter of life or death. (emphasis mine) The whole op-ed is worth reading, especially the $293 million budget cut the CDC took as a result of the sequester. The greatest damage austerity can do is hamper our ability to monitor and understand its pernicious effects. Read: How Austerity Kills

Reparations From Banks – NYTimes.com

After five years, the banks are starting to be held to account. Last week, JP Morgan: The government’s attempts to hold banks accountable for their mortgage practices may finally be paying off. On Friday, JPMorgan Chase agreed to pay $5.1 billion to the regulator of Fannie Mae and Freddie Mac to resolve charges related to toxic mortgage securities sold before the financial crisis. That amount had been negotiated as part of a broader $13 billion settlement — yet to be finalized — between the bank and state and federal officials over the bank’s mortgage practices. JP Morgan will pay a total of $13 billion in fines to the government, and apparently has not secured immunity against criminal prosecution. And this is just one bank: Countrywide, Bank of America, and many others were even more implicated in (and enriched by) the fraud that led to the mortgage meltdown, and subsequent collapse of property markets and local budgets. Think of this amount in relation to the $14 billion in debt that Detroit is trying to get out from under, a number often tossed out ($14 billion!!) as if it’s catastrophic, an amount far beyond bailouts or creditor negotiations. Read: Reparations From Banks – NYTimes.com. 10/25/13

Bankruptcy for Ailing Detroit, but Prosperity for Its Teams – NYTimes.com

The Detroit slide into bankruptcy is like describing an elephant: hard to know where to start. The narratives circulating about Detroit are all fascinating, sometimes irritatingly (but predictably) simplistic but I think the reporting has improved with time, as reporters are forced to look for new angles. Here’s the New York Times’ latest piece: Detroit’s glittering sports teams operate in a different economy than does the rest of the city. Because of billionaire owners, lucrative television deals, dedicated fans and public subsidies, the city’s teams have few of the problems that have dragged their hometown into the largest municipal bankruptcy filing in the nation’s history. Read: Bankruptcy for Ailing Detroit, but Prosperity for Its Teams – NYTimes.com.

Here Is Every Foreign Country That Gets More Federal Aid Than Detroit – Next City

There’s a lot to say about these kind of comparisons (do we really want to get people to pit struggling cities against (in some cases) struggling countries?) but the raw numbers are interesting. Even more interesting would be a historical comparison of federal aid to Detroit and other U.S. cities (spoiler alert!). I Here Is Every Foreign Country That Gets More Federal Aid Than Detroit – Next City.

The Racial Dot Map: One Dot Per Person for the Entire U.S.

Just for good old mapping fun. The Racial Dot Map: One Dot Per Person for the Entire U.S..

Rich people, poor people

Mayor Bloomberg’s interesting framing of how rich people bring more money to the city’s budget, which helps the many poor people living in the city (yes, despite all the frenzy about hipsters in NY, 46% of New Yorkers’s live under 150% of the federal poverty threshold, or less than $35,775 for a family of four). “Other cities have much lower inequality levels,” Mr. Bloomberg’s press secretary, Marc LaVorgna, said, citing Detroit and Camden, N.J. “Are those better places for low-income families to live? Or would they be better off if they had more wealthy people, and a larger income gap, to provide a larger tax base to support a police department that keeps low income communities safe, funds good public schools and pays for a vast social services network like we do in New York City? New York City is one of a handful of major cities that levy a local income tax on money earned by city residents, but Bloomberg is also talking about the spending that wealthy people do in the city. The latter claim is arguably tenuous (much has been written about whether wealthy people spend more in a local economy than middle-class people, given the nature of consumption patterns). But the tax benefits of income taxes in particular are important, and Bloomberg is right to point out that the more money New Yorkers in (especially rich New Yorkers, since the more you earn the higher your tax rate). Income taxes are also more progressive then property taxes, and less subject to abrupt fluctuations in the property market. In New York for 2013, personal income taxes were the second highest source of tax revenue, after property taxes, and above sales taxes. So…income inequality driven by the growth of income at the top can be spun as “good” for the city budget, but even a mayor like Bloomberg might want to think twice about using the words inequality and good too close to each other.

The Radicalism of Today’s Austerity in One Chart | Economic Policy Institute

The Radicalism of Today’s Austerity in One Chart | Economic Policy Institute.

Left with nothing | The Washington Post

Cities struggling with vacant properties can use their ability to place liens on properties that fall behind on their taxes, a terrific way for cities to reclaim properties not being used by their owners (usually property speculators). Flint and Cleveland have used this, as have other so-called ‘shrinking’ cities. But in this terrible twist, Washington DC is outsourcing the function of placing a lien on homes to investors who are then aggressively foreclosing on homes, most of whom are poor, elderly, and Black. This great story profiles some of the most egregious examples (a man who owed $134 in property taxes lost all of his equity and is now in a nursing home). This is exactly what cities should not be in the the business of doing: persecuting low-income residents and wholesale clearing of those who have invested in their homes and neighborhoods for generations. Left with nothing | The Washington Post.

Daily Reminder of Texas State Budget Cuts – NYTimes.com

Texas’ hostility to public investment is starting to come home to roost in tangible ways. Great piece in the New York Times about how falling transportation funding manifests itself in gravel roads, one of the few places where spending cuts are felt by nearly everyone. Transportation is not the state’s only underfinanced program, but it is in a unique position when talking about the consequences of its budget. Health and human services agencies don’t get to talk about how many more people will get sick or die if their financing is cut. It is somewhere between difficult and impossible to tie public school performance to state financing, if only because so many other variables muddle the numbers. Regulatory agencies don’t wave around projections on how many industrial plants won’t be inspected and what the consequences might be. You have to admire the honesty of the transportation people. This is what you spend, and that is what you get. Cut spending, cut expectations. Easy as pie. They seem to be in one of the rare areas of state government where the people involved are allowed to say right out loud what a budget decision will actually mean. Others have to say they will do more with less, a way of saying that they either didn’t need as much money to do the job as they first thought or that they hope the corners they cut to save money won’t cause anyone any trouble — or at least any trouble that will get noticed by voters and politicians. Read: Daily Reminder of Texas State Budget Cuts – NYTimes.com.

Rich Man’s Recovery – NYTimes.com