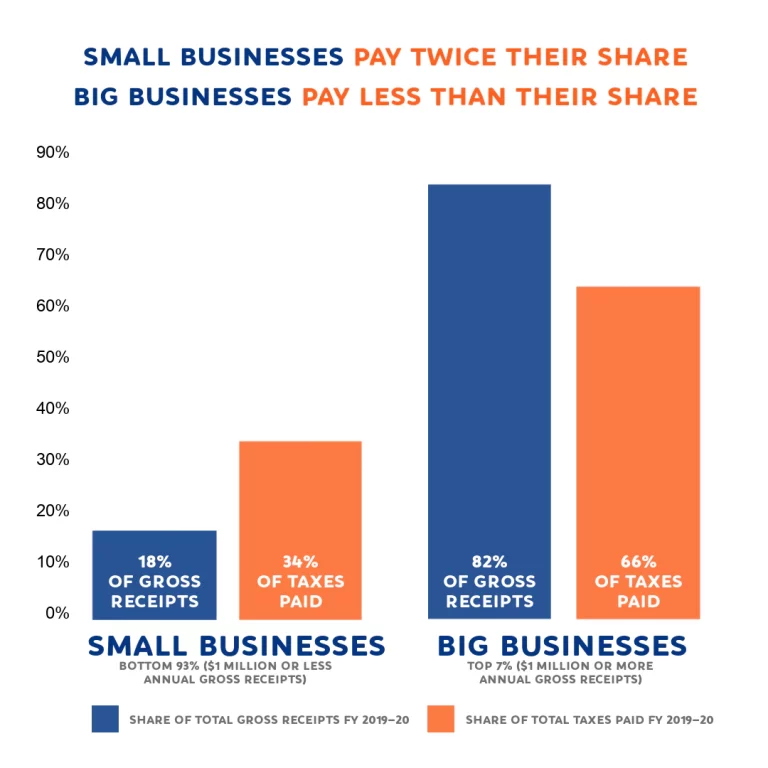

As local economies continue to recover from the pandemic downturn, policymakers are focused on how best to use public policy tools to support resilient and equitable economies. Like many cities, Oakland is examining how its business tax structure aligns with the city’s goals and needs. The City Council is considering a proposal to restructure the…

Category: Cities

Structurally adjusting: Narratives of fiscal crisis in four US cities

The Great Recession unleashed a wave of fiscal stress in the USA, with austerity measures such as spending cuts, service reductions and privatisation predictably taking centre stage. Decades of federal withdrawal from urban policy and funding, combined with state retrenchment, have contributed to a landscape of urban fiscal stress exacerbated by the prolonged effects of…

Post-recession urban politics aren’t helping cities to become financially stable

The Great Recession officially ended in the United States in 2009, but the implications for city governments continue to unfold. Austerity measures implemented by cities well into 2013 left a legacy of service reductions and a backlog of infrastructure needs, a lurking national liability that has drawn attention to cities’ precarious fiscal situation. The long-term effects of the recession on city…

Water woes could sink Flint’s property values even more

The situation in Flint only gets worse: not surprisingly, residents are now worried about their property values, which have already fallen significantly over the past decade. The inability of many residents to sell their homes will only get worse as the reputation of the city’s water supply plummets. This means not only an ongoing crisis…

BART gets real

Infrastructure may not be sexy, but you tend to notice when it crumbles around you. BART has been having all kinds of problems lately, and its twitter account manager isn’t pulling any punches. @tquad64 Planners in 1996 had no way of predicting the tech boom – track redundancy, new tunnels & transbay tubes are decades-long…