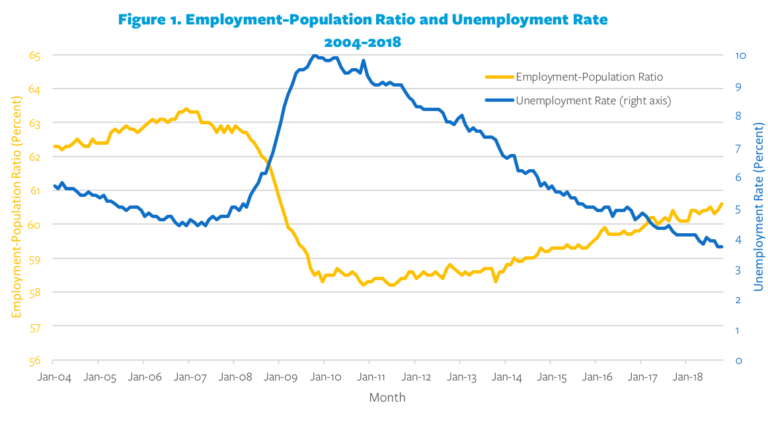

Recovery from the Great Recession has been slow and extremely prolonged. It was tempting to conclude, at various points, that we had recovered as much as we were going to. Even after the official unemployment rate receded, other indicators of recovery remained much more mixed—the share of people employed remained well below pre-recession levels; wages…

Category: Publications

The Great Recession, Families, and the Safety Net

The Great Recession caused significant hardship for many U.S. families. Safety net programs—some of which were expanded during the recession and its recovery—mitigated some of the worst effects, but were not available to all households and were insufficient to compensate for the depth of the downturn. What can policymakers learn from the adequacy of the…

What Really Caused the Great Recession?

The Great Recession devastated local labor markets and the national economy. Ten years later, Berkeley researchers are finding many of the same red flags blamed for the crisis: banks making subprime loans and trading risky securities. Congress just voted to scale back many Dodd-Frank provisions. Does another recession lie around the corner? IRLE Policy Brief

What comes next? Janus v. AFSCME

Today, the U.S. Supreme Court ruled in Janus v. AFSCME in favor of the plaintiff, a local government worker who asserted that being required to pay fees to the union at his workplace violated his first amendment rights. This ruling has been anticipated for years (a similar case, Friedrichs v. California Teachers Association, was deadlocked after Antonin Scalia’s unexpected death).

Earned Income Tax Credit (EITC) Update: California Expansion, Federal Inaction

The Earned Income Tax Credit (EITC) is now the primary anti-poverty program in the U.S., but it has not kept up with wage stagnation. Berkeley faculty recently proposed an increase in the federal EITC, California has adopted an expansion of its own state EITC, and Congress passed a tax bill that fails to help EITC…